Borrower & Investor Personas: Who Uses PLDI and Why It Works

Noble Capital | Private Lending Direct One (PLDI)

Real People. Real Projects. Real Returns.

Private lending is more than a transaction—it’s a relationship. Through PLDI, investors fund real borrowers with real goals, while enjoying predictable, asset-backed returns. Here’s a closer look at the people behind the projects—and the investors behind the capital.

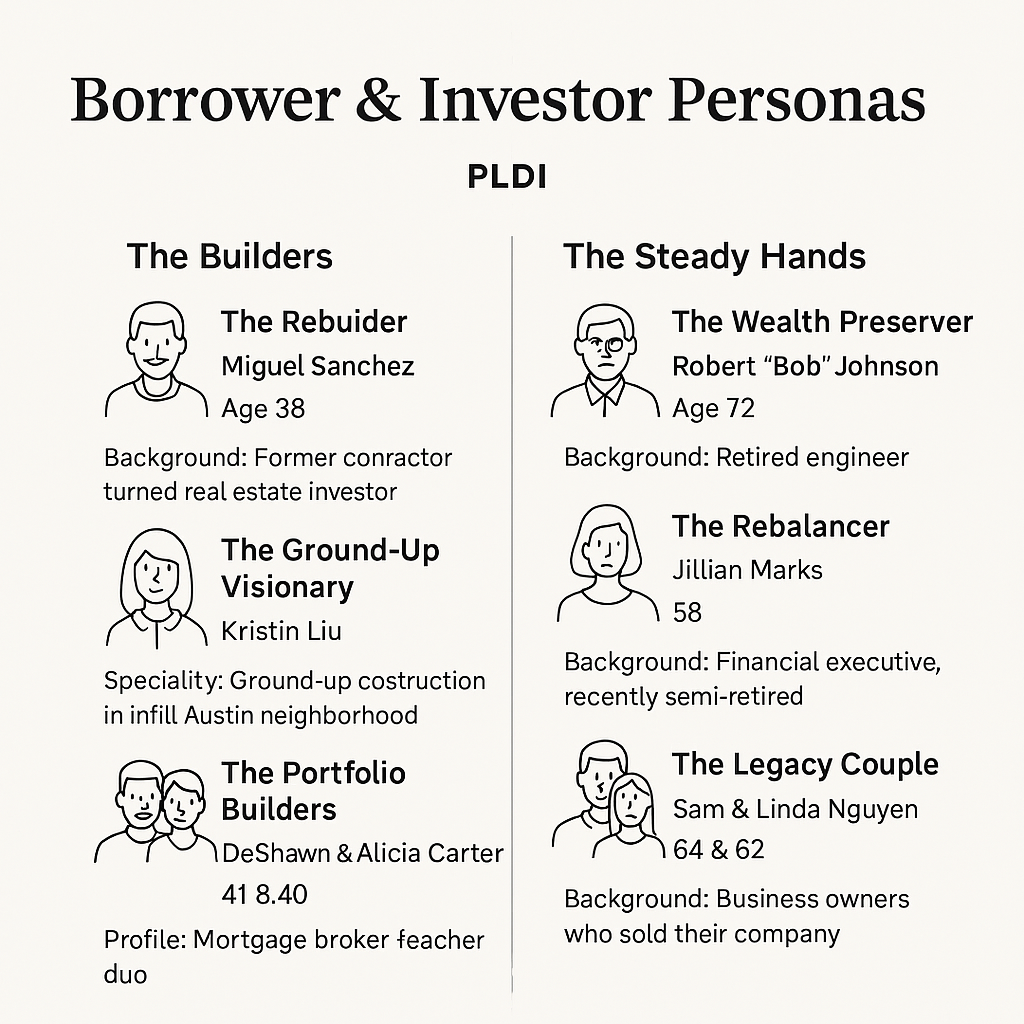

Borrower Personas: The Builders

1. The Rebuilder

Name: Miguel Sánchez

Age: 38

Background: Former contractor turned real estate investor

Specialty: Fix-and-flip / distressed property renovation

Track Record: 20+ rehab projects in Central Texas

Profile:

- Started as a handyman; built experience from the ground up

- Manages a lean crew and runs tight budgets

- Self-performs demo and framing

- Uses hard data and field savvy to identify value

Why He Borrows from Noble:

“It’s not just about getting the funds fast. It’s about knowing my lender understands the project — and that they want me to win.”

2. The Ground-Up Visionary

Name: Kristin Liu

Age: 32

Background: Former architect; now a residential developer

Specialty: Ground-up construction in Austin infill neighborhoods

Track Record: Built 12 homes in the last 4 years

Profile:

- Passionate about design and community-driven housing

- Keeps operations lean; subs out trades

- Chooses PLDI to bypass red tape and stay agile

Why She Borrows from Noble:

“When I pitch investors, I’m pitching vision. With Noble, I’m not pitching — I’m partnering.”

3. The Portfolio Builders

Names: DeShawn & Alicia Carter

Ages: 41 & 40

Background: Mortgage broker + teacher

Specialty: Build-to-rent and rental rehab

Track Record: 9 single-family rentals, 3 duplexes

Profile:

- Focused on scaling to 50 doors

- Rehab distressed properties and refinance for long-term hold

- Use PLDI to bridge acquisition and rehab

Why They Borrow from Noble:

“It’s about speed, flexibility, and trust. We’ve worked with Noble on five deals now — they’re in our corner.”

Investor Personas: The Steady Hands

1. The Wealth Preserver

Name: Robert “Bob” Johnson

Age: 72

Background: Retired engineer

Profile:

- Lives in San Antonio; longtime landlord turned passive investor

- Uses a Self-Directed IRA

- Conservative, numbers-driven, focused on income

Why He Invests in PLDI:

“I’m not gambling. I want my money working every month, backed by real property — that’s what PLDI gives me.”

2. The Rebalancer

Name: Jillian Marks

Age: 58

Background: Semi-retired financial executive

Profile:

- Shifting from equities to yield-focused assets

- Drawn to tax-advantaged alternatives

- Comfortable with Texas real estate over volatile markets

Why She Invests in PLDI:

“It’s an elegant model — first-lien, local, secured. I can sleep at night knowing where my money is.”

3. The Legacy Couple

Names: Sam & Linda Nguyen

Ages: 64 & 62

Background: Former business owners

Profile:

- Looking for income and long-term family wealth

- Deep Texas roots; value local investing

- Care about who’s behind the deal

Why They Invest in PLDI:

“We like knowing who’s on the other end of the deal. Texans lending to Texans — that resonates with us.”

Real Connections. Real Impact.

PLDI isn’t just a financial tool—it’s a bridge between visionary borrowers and principled investors, all working toward shared success.